By

SwitchON Foundation, an SDC-IWMI SoLAR innovation fund grantee, is enabling farmers in East and West Midnapore, Nadia, and North 24 Parganas districts of West Bengal to avail of a state government subsidy for SIPs, by facilitating bank loans for them through the Ratnakar Bank Limited (RBL).

SoLAR Panel on site / Image credit: SoLAR-SA

In the wake of the pandemic and the nationwide lockdown in April 2020, Ujjal Mondal and his sons left their iron foundry jobs in Tamil Nadu to return home to West Bengal. But back at home, their only means of earning was a 2- 3 bigha paddy plot and Ujjal’s occasional carpentry assignments. The family, however, would grow some vegetables for their own consumption, which saved them from having to buy these at high prices from the open markets. Ujjal and his wife, Sutapa, were now primarily concerned about augmenting their earnings from farming, anticipating the job prospects in the city to not improve much in the coming days.

SwitchON Foundation was already advocating for solar irrigation pumps in the Contai block of East Midnapore, where Ujjal and his family lived. Talking to the Foundation representative, Ujjal understood that switching from diesel to solar for irrigation may benefit him in multiple ways – i) cost-saving, ii) multiple-cropping, and iii) enabling the participation of women members of the family in farm management.

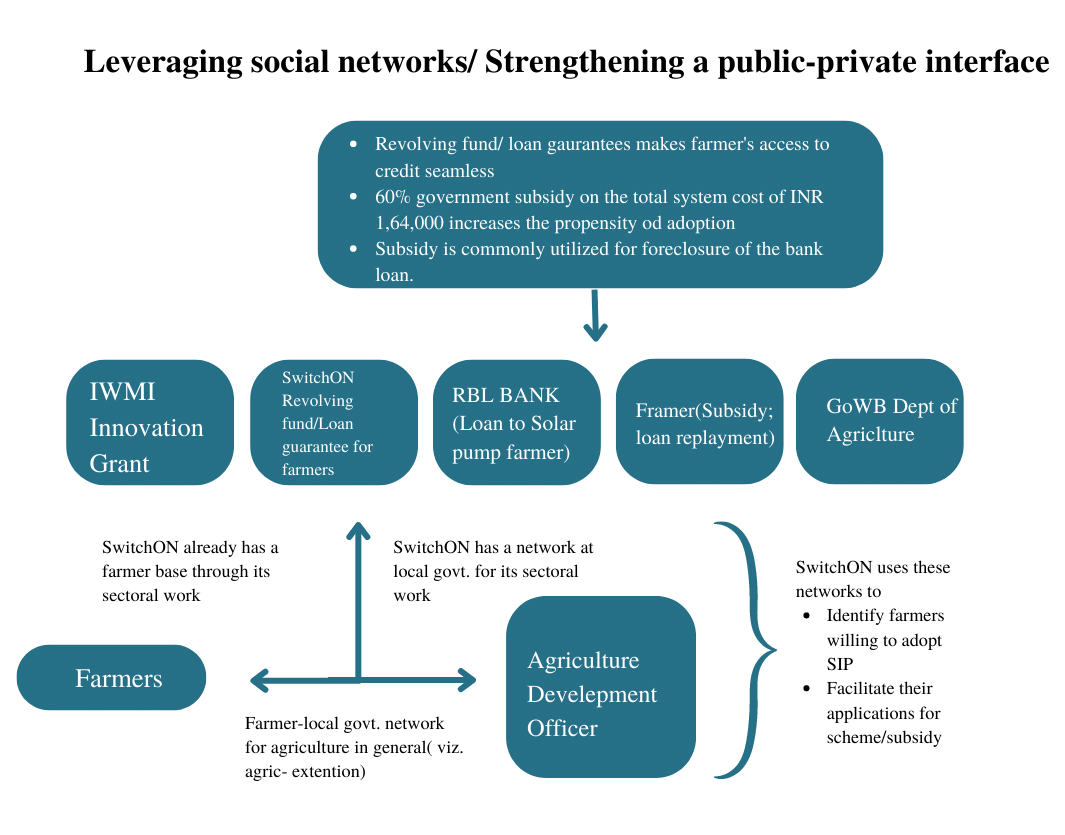

At the same time, via his visits to the block Agriculture Development Officer, he had known about a state government subsidy for solar irrigation pumps (SIP). But there seemed to be more hurdles than enablers along the way: First, the paperwork seemed too daunting for him to navigate on his own. Second, the subsidy will cover about 60% of the total system cost of INR 164,000. In comparison, the remaining 40% will be his out-of-pocket expense. Third, to incur this 40% upfront expenditure, he must resort to a bank loan. But will a bank honor his loan application ever?

Accessing institutional credit for agriculture is historically a struggle for smallholder farmers in India. NABARD (2016) estimated only a fifth of the total loan potential of the Kisan Credit Cards (KCC) to get disbursed to the farmers. While banks find it difficult to sanction loans to a smallholder without sufficient collateral, complex paperwork and penalties on delayed repayments can dissuade the latter from availing of a bank loan. As a result, government subsidies that play a crucial role in the uptake of solar irrigation pumps (SIP) in smallholder agriculture are fraught with elite capture.

With an innovation fund (IF) grant from the SDC-IWMI SoLAR project, SwitchON stepped in to break the ice. Especially by bridging the credit access gap for the so-called ‘non-bankable’ smallholder farmers like Ujjal.

The real stroke of innovation in this IF grant pilot project is SwitchON’s First Loan Default Guarantee model for solar pump financing through the RBL bank in West Bengal. The Foundation facilitates bank loans for their beneficiary farmers by pledging the SoLAR grant as a rolling (default) guarantee fund at the lending bank.

Access to bank loans enables the farmers to avail and utilize the subsidy. They can bear the upfront installation expenses during the 2-3 months required for the subsidy amount to be disbursed to their respective bank accounts. Once paid, they then use it for foreclosing their bank loan.

Underlying the model is a nifty trust-building exercise facilitated by SwitchON. Already a well-known practitioner in the renewable energy sector in Eastern India, SwitchON has leveraged its established networks to strengthen a public-private interface. It has linked the farmers, government, and banks into a workable nexus.

First, it connects the willing farmers to a feasible government (subsidy) scheme. For example, in West Bengal, instead of depending on the limited central government (KUSUM -C) subsidy for grid-connected SIPs, the Foundation has enabled farmers to take recourse to the more readily accessible grants for standalone, small-capacity (2 HP) solar pumps, from the state government’s Financial Support Scheme for Farm Mechanization (FSSFM).

IWMI researchers visiting SWITCHON / Image credit: SoLAR-SA

Second, its two-pronged strategy – loan default guarantee plus loan foreclosure – bolsters the confidence of institutional lenders’ to expand their agricultural lending portfolio, especially for the smallholder farmers.

During their visits to the Foundation’s pilot sites in the Contai and Ramnagar blocks of East Midnapore, on June 21, 2022, the IWMI team saw a solar-led diversification of the local cropping systems. Farmers like Ujjal Mondal, erstwhile mono-cropping paddy, are now into integrated farming with paddy, fish, and vegetables.

In the Contai II sub-block, farmers like Sukumar and Pari Giri have diversified their traditional nurseries with a newer mix of fruits, vegetables, and flower varieties.

SIPs have also enabled an additional avenue of income through water selling. Shifting to solar from diesel has reduced own irrigation costs of the SIP farmers. These farmers are now selling water to the non-SIP farmers in the neighborhood at a 20% lower price than the diesel pump owners.

By Sunipa Das Gupta, Communication Consultant, SoLAR-SA